On digital marketplaces like Zalando, ASOS, and Amazon, the Buy Box is the primary gateway to sales. When a shopper clicks “add to basket,” the Buy Box decides which seller gets the order. In many categories, more than 80% of transactions flow through the Buy Box winner.

For fashion brands, this creates both opportunity and risk. Marketplaces provide unmatched reach and visibility — but they are also hyper-competitive environments where dozens of sellers may compete for the same product. Winning the Buy Box can mean an immediate spike in conversions; losing it can mean disappearing from the customer’s path to purchase.

How the Buy Box Works in Fashion

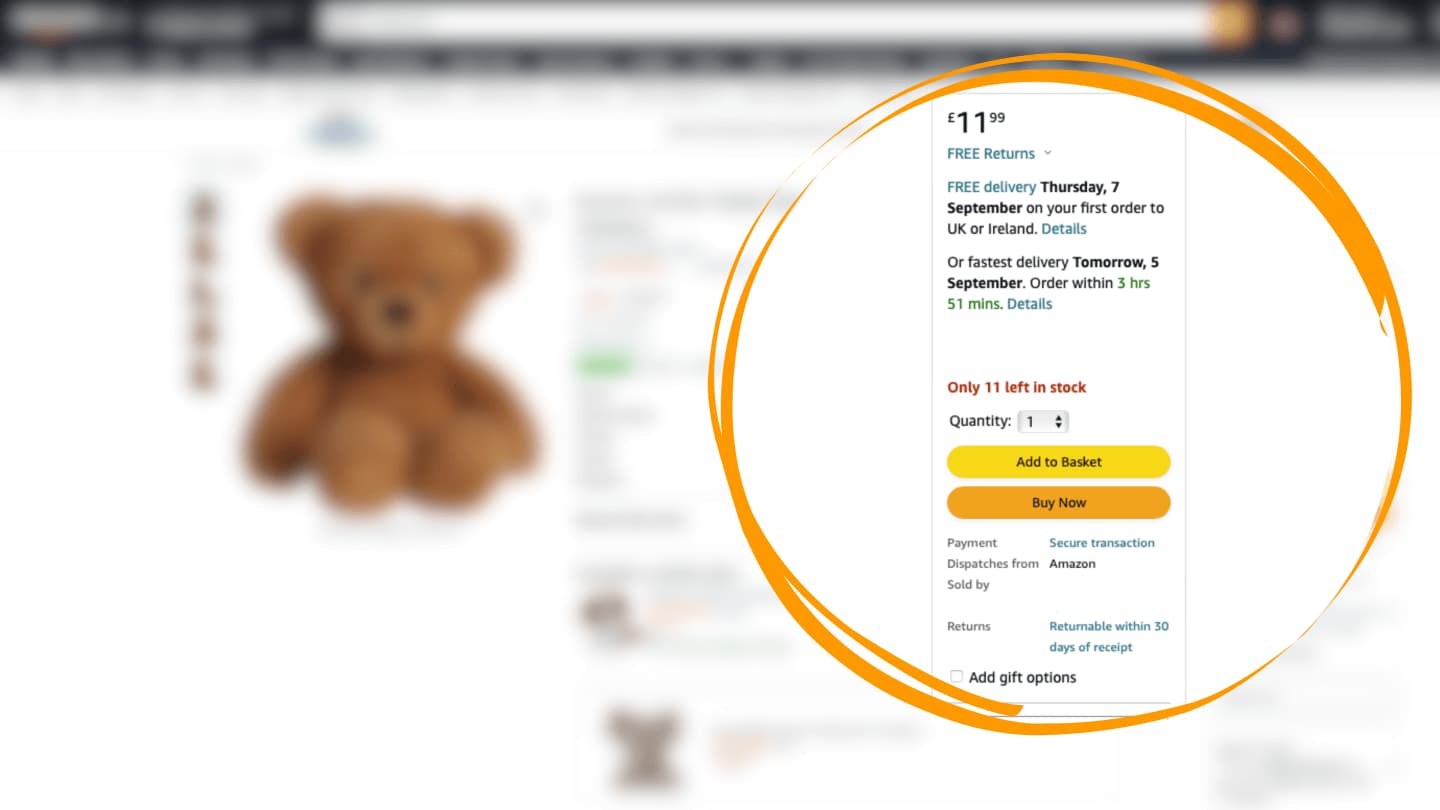

While algorithms vary by marketplace, most consider a mix of:

* Price – both base price and discounting

* Availability – consistent stock across sizes and colors

* Fulfillment speed – faster delivery improves odds of winning

* Seller performance – ratings, returns, and service quality

In fashion, these factors apply at the SKU-variant level. A brand may hold the Buy Box for one colorway or size, but lose it to a third-party seller for others — creating blind spots in visibility and lost sales opportunities.

The Challenges for Fashion Brands

Margin erosion from endless price matching

If one reseller drops price by 10%, others quickly follow. The result is a downward spiral that erodes margin and sets a lower reference price across channels.

Unauthorized and parallel sellers

Third-party sellers can undercut official listings, winning the Buy Box while diluting brand control and consistency.

Loss of brand experience

Even when products are authentic, inconsistent fulfillment or returns from resellers can hurt brand perception.

Sheer scale of competition

With millions of SKUs updating constantly, brands compete not just with rivals but with resellers, price changes, and promotions.

In footwear, studies show that up to 80% of Buy Box losses occur on just 20% of SKUs — typically the most in-demand sizes and colors. Missing those critical variants means losing visibility where it matters most.

Sustainable Strategies for Buy Box Wins

Winning the Buy Box doesn’t mean racing to the lowest price. Leading brands treat it as a strategic balance of visibility and profitability:

* Prioritize high-impact SKUs

* Understand competitor behavior and timing

* Benchmark across variants

* Monitor third-party sellers

* Exercise margin discipline — not every Buy Box is worth defending

The Role of Data and Insights

The speed and scale of marketplace dynamics make manual management impossible. Thousands of SKUs, hundreds of competitors, and constant price changes demand real-time visibility.

With the right intelligence, brands can:

* Track Buy Box ownership by SKU and size

* Identify where margin pressure is most acute

* Spot price spirals before they accelerate

* Decide when to defend and when to hold margin

The result isn’t just more Buy Box wins — it’s smarter, more profitable wins.

How Norna Helps

At Norna, we provide the data foundation that enables these decisions.

Our technology continuously collects and harmonizes marketplace data — prices, stock, resellers, and fulfillment details — across millions of SKUs.

By combining deep product matching with near real-time updates, Norna helps brands:

* See when and why Buy Box ownership changes

* Detect third-party activity impacting price or brand control

* Benchmark competitors’ offers and promotions

* Focus efforts where visibility drives real commercial value

For brands selling on marketplaces, clarity is power.

The Buy Box can’t be controlled — but with the right insights, it can be managed strategically and profitably.

#marketplaces #zalando #asos #pricing #buybox #fashion #retaildata #norna