Spring collection: more expensive, later, and more limited assortment range

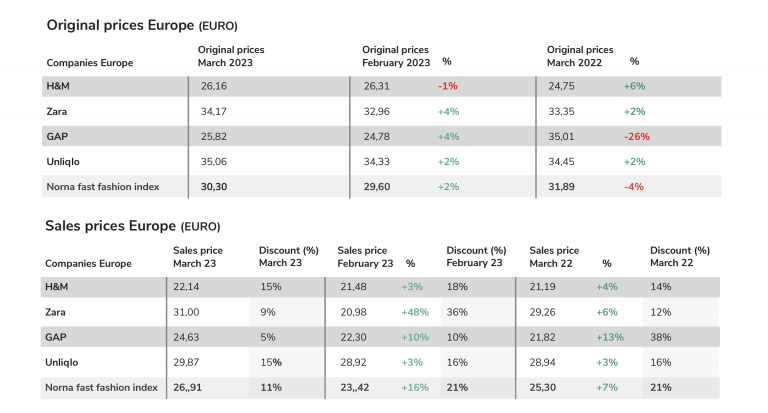

Zara and H&M, the two major players in fast fashion, have raised their original prices by an average of 4% and their sales prices by 5% compared to last year, according to Norna Analytics’ monthly report on the four largest fashion companies. At the same time, the industry has halved its sale prices.

– This year’s spring collection is more expensive, its later, and it has a more limited assortment range. It’s a clear adjustment to consumers who are being squeezed by inflation,” says Michael Collaros, CEO of Norna Analytics.

Zara leads the way with a 6% increase in their sales prices and an 8% decrease in inventory. They are likely spreading out the collection over a longer time period, or they have completely changed their assortment strategy. Meanwhile, the entire industry is increasing sales prices.

H&M and Zara have chosen different approaches to original prices. H&M, which raised prices by 8% in February, is now staying at 6%. Zara, on the other hand, is raising its prices from 0% to 2%. The American company Gap is also making significant changes in Europe, where they are reducing their assortment range and slashing prices, while Uniqlo’s prices and assortment range remains mostly unchanged.

H&M continues to lead price increases, with a 6% original price increase standing out in the industry, which is otherwise more cautious. The industry’s average price increases are lower than the overall inflation rate. This may be due to companies being cautious and, like H&M, due to them successfully lowering their purchase prices, says Michael Collaros.

Zara increasing sales prices by 48%

Fast fashion’s actual sales prices are rising more evenly, or 7% compared to last year. Gap, which was stagnant in February, is now increasing prices the most, double to the industry average.

– The ability to change prices varies greatly in the industry. Zara varies its prices the most, increasing sales prices by a whopping 48% compared to February. Compare that to the 3% price adjustments at H&M and Uniqlo. They obviously have very different approaches, says Michael Collaros.

Smaller range in spring collection

Fast fashion displays two different assortment range strategies. H&M is the most aggressive and is the only one expanding their own brand by 1%. Additionally, H&M has increased their assortment range by 6% from 105 other brands (Source: Norna Analytics, March 20). The four major players in fast fashion together reduced their assortment range by 4% to 76,000 items per market compared to last year.

It is mainly Zara that is reducing its assortment range, with a decrease of 26% compared to the previous month and 8% less than March of 2022. It appears that Zara’s spring collection will arrive later in stores this year, or maybe it reflects a dramatically new assortment strategy to cater to poorer consumers, says Collaros.

The sales continue

Spring sales is both shortened and extended this year in fast fashion. Zara’s spring sales are quite short this year, while H&M and Uniqlo have extended theirs. In March, both had a 15% lower sale prices than the original prices, continuing from February. On the other hand, Gap has changed direction and now only has 5% of the assortment on sales, down from last year’s 38%.

– Zara has mostly ended their sales. They lowered their prices by 36% in February, but only by in 9% March, while the spring collection is also waiting to be fully launched. Zara is clearly acting more cautiously this year, says Michael Collaros.

Source: Norna Fast fashion index March. Published April 6 2023